International Trade Overview on LPG

LPG global trade expanded each year over the 2020 to 2024 period and continued through April 2025. Rising US exports, increasing demand globally for LPG as a petrochemical feedstock and a cleaner fuel, and the ban on EU imports from Russia were key market drivers.

Global trade in LPG reached 99.7 million tons in 2024, with US exports rising from 48% of the total in 2020 to 51% in 2024.US exports totaled 17.2 million tons through April, 2025, up 5%. Lower shipments to Japan and South Korea, among others, were offset by gains in other markets, including China (noting reduced trade tensions recently between the US and China), Mexico, Netherlands, Belgium,Indonesia, Singapore and France.

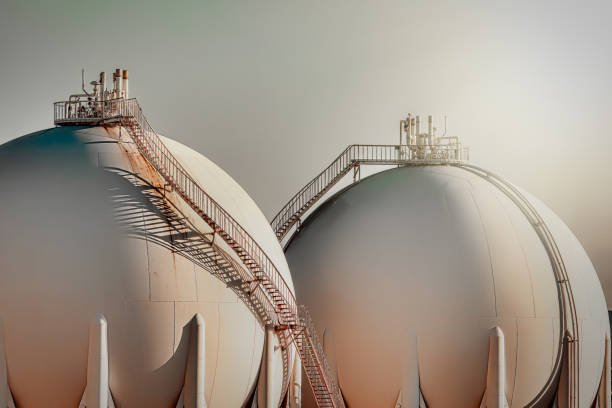

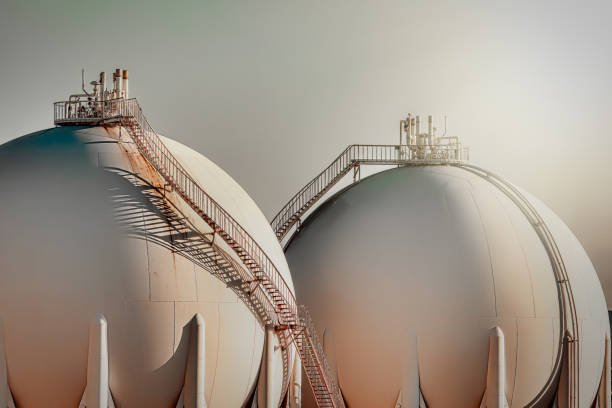

Liquefied petroleum gas (LPG – principally propane and butane) has evolved into one of the fastest-growing maritime commodities. It powers homes and vehicles, feeds petrochemical plants, and serves as a transitional energy source in the global decarbonisation agenda . The global seaborne LPG trade has grown significantly, with Asia remaining the largest importing region. The Middle East and the United States have become the leading exporters, supplying approximately 80% of global exports.

Hazard and Risk Landscape

The carriage of LPG presents a distinct risk profile requiring precise technical and procedural control.

- Fire and Explosion: LPG and ethane vapours are heavier than air and easily ignited. Static discharge or manifold leaks can cause serious losses. Adherence to SIGTTO Ship-Shore Interface Guidelines is essential for prevention.

- Cryogenic Stress: Uneven cooling during cargo operations can lead to brittle fracture, particularly on ethane carriers, where temperature gradients are more severe.

Contamination and Off-Spec Cargo: Even minor deviations in propane-butane ratio or trace moisture can render a cargo unsaleable, triggering contractual and insurance disputes. - STS and Terminal Interface Risk: Operations should be covered by proper STS transfer standards covering fendering, mooring, and ESD interlocks. Breaches in these areas can lead to pollution and property claims.

- Deviation and Mis-Delivery: Mid-voyage resales often prompt requests for discharge without bills of lading, a source for potential disputes.

- Regulatory Compliance: Breaches of SOLAS or MARPOL Annex VI, particularly regarding vapour emissions, may result in fines.

Common Flashpoint

Measurement and shortage disputes are a common flashpoint. LPG cargoes are traded on tight specifications and rely on precise thermodynamic corrections for volume, pressure, and temperature. Even small inaccuracies in calibration or incomplete cargo logbooks can undermine a Member’s defence in shortage or contamination claims. The Club’s technical risk assessment team often stresses the importance of consistent data integrity. Records must be detailed enough to reconstruct every transfer operation from start to finish.

Letters of Indemnity (LOIs) – Common Requests, Consistent Risks

In the LPG and wider gas carrier trades, Letters of Indemnity (LOIs) are a constant feature of commercial operations, but also one of the most misunderstood instruments in maritime practice. They are frequently used to overcome documentary or logistical delays to fill the hole in P&I cover that is created when actions that fall outside the lawful terms of carriage.

Some charterers request cargo heating, typically to ease discharge at terminals lacking full refrigeration capacity. Such actions, if not properly controlled, can increase vapour pressure, damage containment systems, and jeopardise the vessel’s structural integrity.

The Club’s position is unequivocal: an LOI does not make the uninsurable insured. Members are urged to use only International Group approved templates, ensure that the issuer is financially reliable, and refuse any indemnity that demands conduct contrary to law, safety, or good seamanship.